Do I Have To Pay Taxes On A Accident Settlement

That is because most personal injury claims involve physical injuries which the IRS treats as non-taxable. Generally settlement and verdict proceeds from a personal injury claim are not subject to state or federal income tax according to Section 104 of the tax code.

Pain And Suffering Settlement Examples Car Accidents And More 2021

Fortunately the short answer is no.

Do i have to pay taxes on a accident settlement. If you are injured in a car crash and get. Information on estimated taxes can be found in IRS. However there are cases where some of your compensation is taxed.

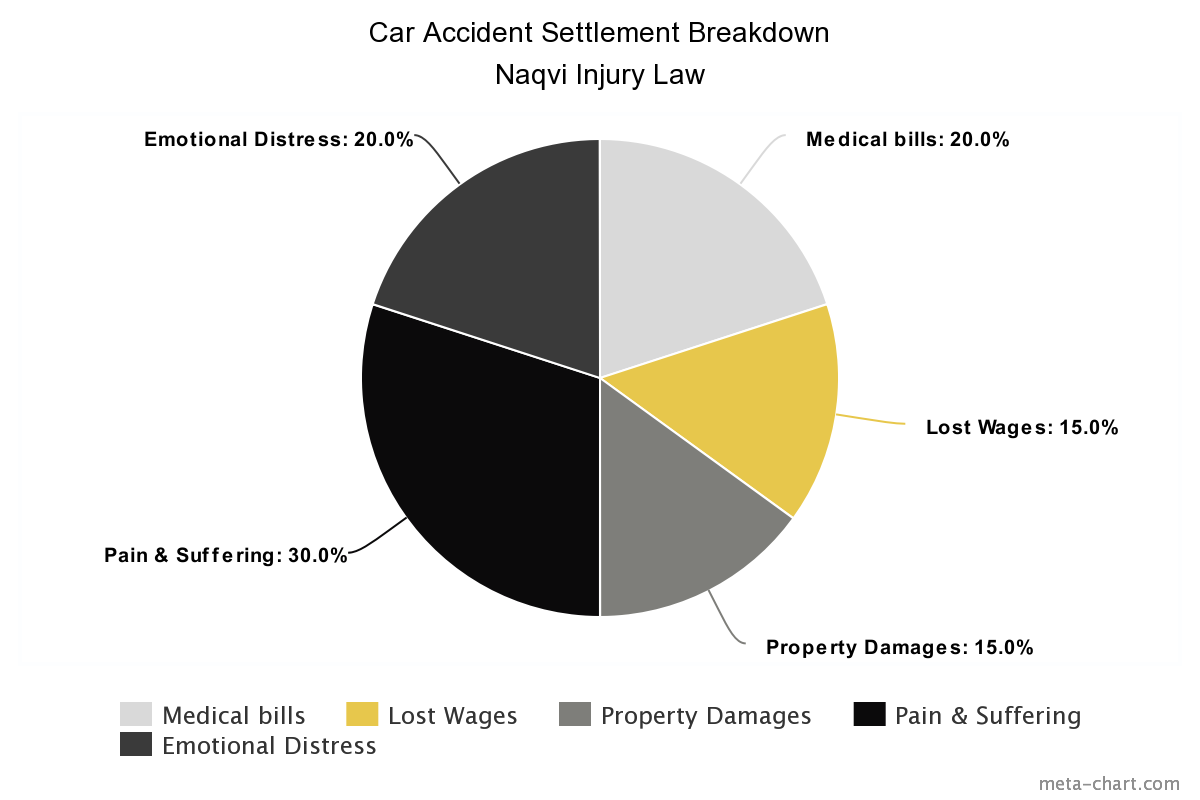

Didnt used to be that way about 8 years ago but then they closed to lawsuit settlement tax loophole. But any portion of the settlement which is designated for pain and suffering I suspect you will have to pay tax on it. For example compensation for lost income or lost profits is usually taxable but compensation for injuries is not.

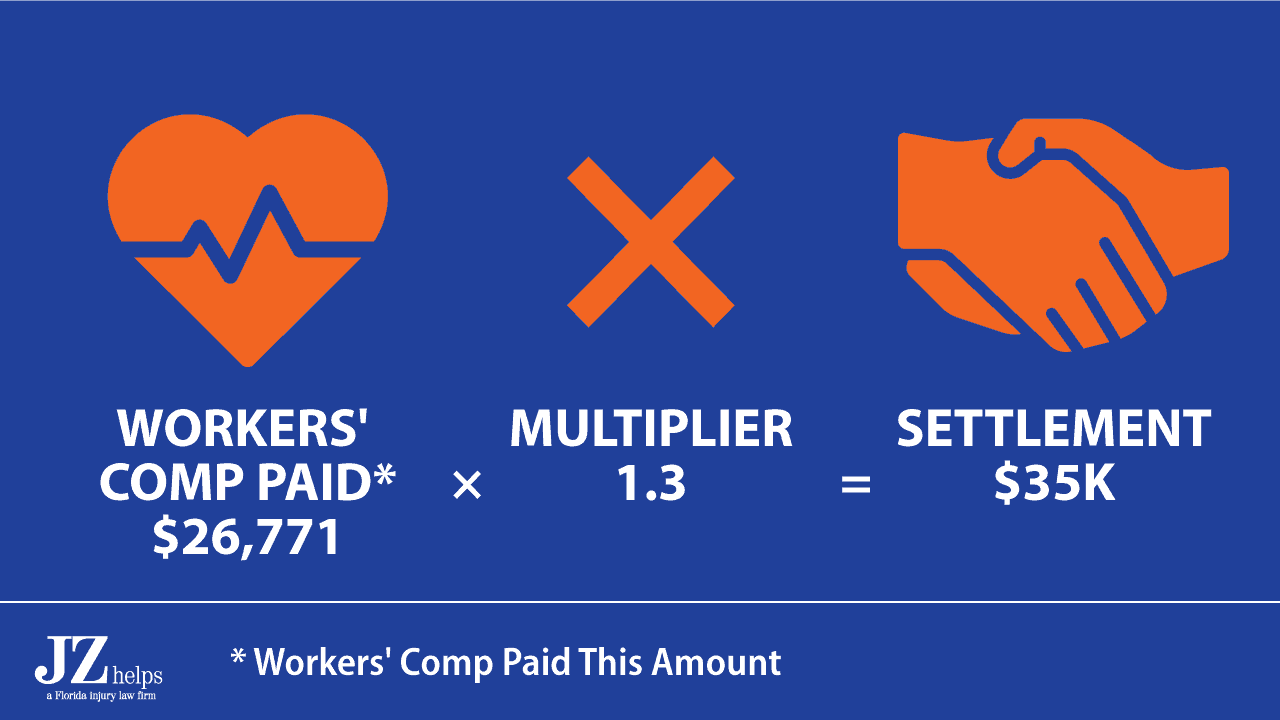

After being paid out a settlement for a personal injury claim you may be wondering what the tax implications will be. Some of these payments will be treated as. Before the distribution of your settlement ICBC calculates any lost wages from the accident and they deduct the amount of taxes you would have paid if you had received that income from the settlement before you receive it.

The answer to this question is yes but fortunately not all of your settlement will be taxed. Today at 312 236-2900. If youre offered a Settlement Agreement by your employer its usually made up of different payments.

Compensation for Your Personal Injuries In most situations your settlement funds for physical injuries resulting from a car accident are entirely tax exempt. When you receive funds for a general settlement including those for physical injuries and associated medical expenses most of that settlement is not subjected to taxes. We urge you to call our office for.

If you have received a settlement or judgment following a vehicle accident youre probably wondering Do I have to pay taxes on that money The short answer is In most cases no However that is not a hard and fast rule and the answer depends on the nature and circumstances of your settlement. Tax Implications of Settlements and Judgments. This means you should not include your accident settlement when declaring income.

Whether you settle your case beforehand settle halfway through or take the trial all the way to a verdict you do not have to pay taxes on your settlement. Do I Pay Tax on a Settlement Agreement. This blog post will address these concerns.

Below is a short explanation of the issue of taxes on settlements. Recently I settled an employment-discrimination case and I had to pay taxes on it. This is actually very helpful that way the victim saves a considerable amount of money and can use the entirety of the settlement.

PAYING INCOME TAXES ON AN ACCIDENT SETTLEMENT. Punitive damages and interest are always taxable. If youre in court and suing for a personal injury the general rule is that you are not responsible for paying taxes if you win your lawsuit.

Yes in England and Wales you may have to pay tax on a Settlement Agreement but it depends on the types of payments you receive as part of your settlement. If you receive a car insurance settlement stemming from an accident you are likely wondering if you will have to pay taxes. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code IRC Section 61 that states all income is taxable from whatever source derived unless exempted by another section of the code.

Generally you dont need to pay taxes for physical injuries and sickness. However there are exceptions. One of the issues that many of our clients face when they settle a vehicle accident including accidents involving cars bicycles trucks pedestrians and motorcycles is whether they must pay income taxes on the money they receive.

Filing an accident claim with ICBC can. You only pay taxes on a car accident settlement if the settlement you received includes taxable money you would have received had you not been injured. Some settlement recipients may need to make estimated tax payments if they expect their tax to be 1000 or more after subtracting credits withholding.

Normally there is no need to pay any taxes for an auto accident insurance settlement. Tax advice early before the case settles and the settlement agreement is signed is essential. If you received a settlement for personal injury or sickness and did not take an itemized deduction for medical expenses related to the injury or illness the full amount of your accident settlement is non-taxable.

For information on whether you have to pay taxes on your car accident settlement contact the lawyers of Staver Accident Injury Lawyers PC. Do i have to pay tax on my settlement after a car accident. 1040 Schedule 1 even if the punitive damages were received in a settlement for personal physical injuries or physical sickness.

This is because you are receiving a direct reimbursement for your out-of-pocket costs related to the accident. IRC Section 104 provides an exclusion. It all depends on what type of compensation you got in your settlement.

To fully understand how much of your settlement is taxable reach out to a personal injury attorney or a tax attorney. You wont have to pay taxes on most motor accident settlements.

Pain And Suffering Settlement Examples Car Accidents And More 2021

When Are Car Insurance Settlements Taxable Insurance Com

Free Legal Consultations For Recent Orange County Car Accident Victims Who Must Act Quickly To Build Personal Injury Law Personal Injury Law Firm Injury Lawyer

Top Auto Accident Attorney For 2019 Top Attorney Accident Attorney Car Accident Lawyer Attorneys

Is My Personal Injury Compensation Taxable Torklaw Personal Injury Personal Injury Law Personal Injury Attorney

Singapore Has An Excellent Reputation For Offering A Set Of Legal Agreement Advantages For Such As An Outstanding Tax Syst Document Sign Lettering Accident

If You Are Planning To Stay In Karnataka Then Pay Your Road Tax Sooner To Avoid Any Penalties Rto Services Roadtaxcalculator R Road Tax Driving School Road

Pain And Suffering Settlement Examples Car Accidents And More 2021

Personal Injury Solicitors Specialize In Accidents On The Road And At Work Due To Trips Falls Slips Or Any Othe Personal Injury Person Personal Injury Claims

Pin On Motorcycle Accident Lawyer

How Long Your Car Accident Settlement Will Take

What To Know If You Refuse A Car Accident Settlement Ny

Do I Need To Pay Tax On A Vehicle Accident Settlement Or Judgment Nolo Com Paying Taxes Judgment Car Accident

How Much Will Auto Insurance Increase After Accident Di 2021

How Long Does It Take To Get A Settlement Check After A Car Accident

Are Auto Accident Settlements Taxable Naqvi Injury Law

Pain And Suffering Settlement Examples Car Accidents And More 2021

Post a Comment for "Do I Have To Pay Taxes On A Accident Settlement"